Finance managers work with cash, credit, as well as profitability to accomplish an organization's financial goals. These functions are closely linked to the success of a business, so it is essential to have an understanding of the roles and responsibilities of a finance manager. This job requires many of the same skills as an education. Read on to learn about the skills and salary of a finance manager. Finance managers can also be called many other titles, so make sure you research them before applying.

Financial management skills are required

You need the right set of skills to succeed in the finance field. Finance managers must be logical thinkers, who can efficiently use quantitative information. Although some people may consider a basic mathematic background irrelevant for a career in finance, the basic skills are necessary. Finance managers should be able to manage and control projects. Management of projects requires that you consider both long-term and short-term goals as well as cost-cutting considerations.

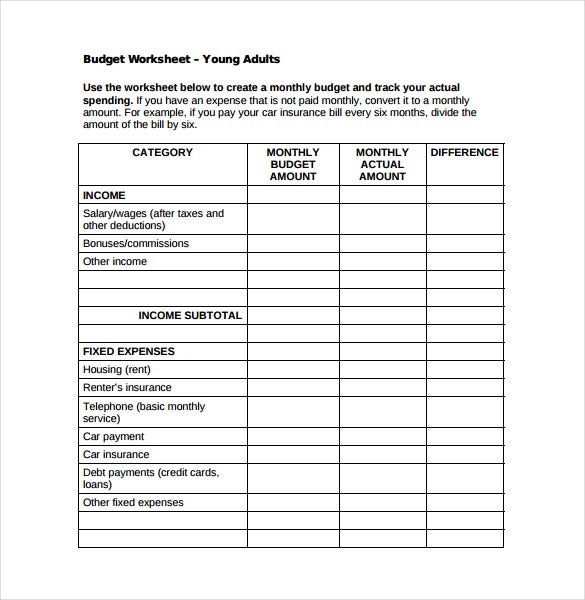

A good finance manager should have excellent communication skills. They must be able to communicate complex financial information with their staff. They should be able budgeting and forecasting, which are two of their main functions. The majority of finance managers will have basic budgeting and forecasting skills and should be able to explain how they create and use budgets. They should also be proficient in using spreadsheets to analyse and report on forecasts.

Education necessary

For financial management, a bachelor's degree will typically be required. You have the choice to specialize in finance or accounting. You can also get a job as a personal financial advisor or in insurance sales. You can also take part-time courses depending on your interests. Most financial managers must have some work experience before they can start their own company. These tips will help you get going.

First, you need to be familiar with the job. Usually, financial managers hold a bachelor's degree in accounting, finance, or economics. A master's degree is sometimes required by some companies, but it is not necessary. Some finance managers are certified public accountants. You will need to take a variety of courses to become a finance manger. Most employers prefer candidates with a master's degree, so if you're looking for this type of position, you should consider enrolling in one.

Salary

Finance managers can earn a salary that is dependent on their experience and educational level. An INR 10 lakh per year can be earned by a mid-level manager, while an INR 12 lakh per annum can be earned by a senior-level manger. Your salary will increase the more you have qualifications. A candidate with a degree from an IT course, like DevOps, or in finance will be preferred over a candidate without an education.

The salaries of finance managers can vary depending on their industry. They may earn anywhere from $70,000 to $160,000 per year. Finance managers are often located in offices near senior management. This allows them to have access to cutting-edge software and computer systems. Additionally, finance managers often travel a lot to meet new business contacts. Traditionally, a finance director spent most of his time compiling financial reports and crunching numbers. However, the job description has expanded to include creative problem-solving as well as brainstorming sessions with senior managers.

FAQ

What is a Financial Planning Consultant? And How Can They Help with Wealth Management?

A financial advisor can help you to create a financial strategy. A financial planner can assess your financial situation and recommend ways to improve it.

Financial planners are highly qualified professionals who can help create a sound plan for your finances. They can assist you in determining how much you need to save each week, which investments offer the highest returns, as well as whether it makes sense for you to borrow against your house equity.

Financial planners typically get paid based the amount of advice that they provide. However, planners may offer services free of charge to clients who meet certain criteria.

What are the benefits associated with wealth management?

Wealth management offers the advantage that you can access financial services at any hour. It doesn't matter if you are in retirement or not. If you are looking to save money for a rainy-day, it is also logical.

You have the option to diversify your investments to make the most of your money.

You could invest your money in bonds or shares to make interest. You can also purchase property to increase your income.

A wealth manager will take care of your money if you choose to use them. You don't have to worry about protecting your investments.

How does Wealth Management work

Wealth Management allows you to work with a professional to help you set goals, allocate resources and track progress towards reaching them.

Wealth managers not only help you achieve your goals but also help plan for the future to avoid being caught off guard by unexpected events.

They can also prevent costly mistakes.

What are some of the different types of investments that can be used to build wealth?

There are many types of investments that can be used to build wealth. These are just a few examples.

-

Stocks & Bonds

-

Mutual Funds

-

Real Estate

-

Gold

-

Other Assets

Each has its own advantages and disadvantages. Stocks and bonds are easier to manage and understand. They can fluctuate in price over time and need active management. However, real estate tends be more stable than mutual funds and gold.

Finding the right investment for you is key. You need to understand your risk tolerance, income requirements, and investment goals in order to choose the best investment.

Once you have determined the type of asset you would prefer to invest, you can start talking to a wealth manager and financial planner about selecting the best one.

Who can I turn to for help in my retirement planning?

Many people consider retirement planning to be a difficult financial decision. It's not just about saving for yourself but also ensuring you have enough money to support yourself and your family throughout your life.

Remember that there are several ways to calculate the amount you should save depending on where you are at in life.

For example, if you're married, then you'll need to take into account any joint savings as well as provide for your own personal spending requirements. Singles may find it helpful to consider how much money you would like to spend each month on yourself and then use that figure to determine how much to save.

If you are working and wish to save now, you can set up a regular monthly pension contribution. It might be worth considering investing in shares, or other investments that provide long-term growth.

You can learn more about these options by contacting a financial advisor or a wealth manager.

What is wealth administration?

Wealth Management is the art of managing money for individuals and families. It includes all aspects of financial planning, including investing, insurance, tax, estate planning, retirement planning and protection, liquidity, and risk management.

Statistics

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

External Links

How To

How to beat inflation using investments

Inflation is one of the most important factors that influence your financial security. Over the last few years, inflation has been steadily increasing. There are many countries that experience different rates of inflation. India, for instance, has a much higher rate of inflation than China. This means that while you might have saved money, it may not be enough to meet your future needs. You risk losing opportunities to earn additional income if you don't invest often. How do you deal with inflation?

Stocks are one way to beat inflation. Stocks offer you a good return on investment (ROI). These funds can be used to purchase gold, silver and real estate. There are some things to consider before you decide to invest in stocks.

First, determine what stock market you wish to enter. Are you more comfortable with small-cap or large-cap stocks? Choose accordingly. Next, learn about the nature of the stock markets you are interested in. Are you interested in growth stocks? Or value stocks? Choose accordingly. Learn about the risks associated with each stock market. There are many stock options on today's stock markets. Some stocks are risky, while others are more safe. Choose wisely.

Expert advice is essential if you plan to invest in the stock exchange. Experts will help you decide if you're making the right decision. Make sure to diversify your portfolio, especially if investing in the stock exchanges. Diversifying can increase your chances for making a good profit. You risk losing everything if only one company invests in your portfolio.

A financial advisor can be consulted if you still require assistance. These professionals will guide you through the process of investing in stocks. They will make sure you pick the right stock. They will help you decide when to exit the stock exchange, depending on your goals.