A financial plan can be used to help you manage your finances. It helps you determine what your biggest financial goals are and how much you need to save to reach them. It also gives you a list of steps to follow to reach them. Financial planners can help you determine your future living expenses, including retirement costs. A financial planner can also analyze investment accounts and contribution amounts.

Assets

Assets are all assets that a company owns that have monetary value and can be easily converted into cash. These assets can be either physical or intangible. They are shown on the balance statement, a critical financial statement. This report describes the assets and liabilities of your company and shows whether it has enough cash to pay its obligations. Assets include cash, stocks, bonds, real estate, and equipment.

Debts

The key to a healthy financial plan is the ability to manage debt effectively. A majority of Americans have some amount of debt. It could be from a car, home purchase, or education. Others may have debt for lifestyle or investment reasons. It is important to understand the differences between different types of debt as well as the risks associated with each one so that you can manage your debt effectively.

Goals

First, identify your financial goals. These should be specific, attainable, relevant, and time-sensitive. Then you can create a realistic budget that reflects these goals. You should keep any money that is not used for your priorities in a separate account. You should monitor how you progress towards each goal.

Budgeting

Budgeting is an important part of any financial plan. Developing a budget helps you to understand what is happening and how much money you have available. You can then make positive changes in your financial future. It can also help you assess your choices and spot potential problems.

Savings

Savings should be a major component of a financial plan. Saving is an easy way of building wealth, unlike investing which can put your money at stake. You may not be saving to reach a specific goal, even though a negative savings balance may signify a poor net worth.

Investing

An important part of any financial plan is investing. You should set aside a portion of your monthly income to invest in an investment account. The amount will increase over time. Remember that investing is a long-term strategy. It could take up to ten years for you to see any real results.

FAQ

What is estate planning?

Estate planning involves creating an estate strategy that will prepare for the death of your loved ones. It includes documents such as wills. Trusts. Powers of attorney. Health care directives. These documents will ensure that your assets are managed after your death.

What is a Financial Planner? How can they help with wealth management?

A financial advisor can help you to create a financial strategy. They can analyze your financial situation, find areas of weakness, then suggest ways to improve.

Financial planners are trained professionals who can help you develop a sound financial plan. They can help you determine how much to save each month and which investments will yield the best returns.

Financial planners typically get paid based the amount of advice that they provide. Some planners provide free services for clients who meet certain criteria.

How to Begin Your Search for A Wealth Management Service

The following criteria should be considered when looking for a wealth manager service.

-

Has a proven track record

-

Locally based

-

Free consultations

-

Offers support throughout the year

-

There is a clear pricing structure

-

A good reputation

-

It is easy to contact

-

Offers 24/7 customer care

-

A variety of products are available

-

Low charges

-

No hidden fees

-

Doesn't require large upfront deposits

-

Make sure you have a clear plan in place for your finances

-

Transparent approach to managing money

-

This makes it easy to ask questions

-

You have a deep understanding of your current situation

-

Understands your goals and objectives

-

Is willing to work with you regularly

-

Works within your budget

-

Has a good understanding of the local market

-

Is willing to provide advice on how to make changes to your portfolio

-

Will you be able to set realistic expectations

What are the benefits associated with wealth management?

The main benefit of wealth management is that you have access to financial services at any time. Savings for the future don't have a time limit. This is also sensible if you plan to save money in case of an emergency.

To get the best out of your savings, you can invest it in different ways.

You could, for example, invest your money to earn interest in bonds or stocks. You can also purchase property to increase your income.

If you use a wealth manger, someone else will look after your money. You don't have the worry of making sure your investments stay safe.

How old do I have to start wealth-management?

Wealth Management can be best started when you're young enough not to feel overwhelmed by reality but still able to reap the benefits.

The sooner you begin investing, the more money you'll make over the course of your life.

If you are planning to have children, it is worth starting as early as possible.

You could find yourself living off savings for your whole life if it is too late in life.

What is risk management in investment administration?

Risk Management is the practice of managing risks by evaluating potential losses and taking appropriate actions to mitigate those losses. It involves monitoring and controlling risk.

Risk management is an integral part of any investment strategy. The purpose of risk management, is to minimize loss and maximize return.

The following are key elements to risk management:

-

Identifying the risk factors

-

Monitoring the risk and measuring it

-

How to manage the risk

-

How to manage the risk

How to Choose An Investment Advisor

The process of choosing an investment advisor is similar that selecting a financial planer. Consider experience and fees.

An advisor's level of experience refers to how long they have been in this industry.

Fees refer to the costs of the service. These costs should be compared to the potential returns.

It's crucial to find a qualified advisor who is able to understand your situation and recommend a package that will work for you.

Statistics

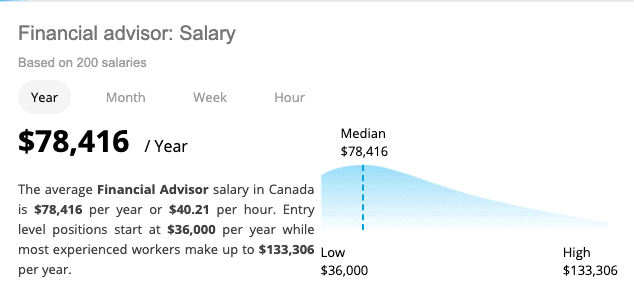

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- Newer, fully-automated Roboadvisor platforms intended as wealth management tools for ordinary individuals often charge far less than 1% per year of AUM and come with low minimum account balances to get started. (investopedia.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

External Links

How To

How do you become a Wealth Advisor

Wealth advisors are a good choice if you're looking to make your own career in financial services and investment. This career has many possibilities and requires many skills. If you have these qualities, then you can get a job easily. A wealth advisor's main job is to give advice to investors and help them make informed decisions.

To start working as a wealth adviser, you must first choose the right training course. The course should cover topics such as personal finance and tax law. It also need to include legal aspects of investing management. After you complete the course successfully you can apply to be a wealth consultant.

Here are some tips to help you become a wealth adviser:

-

First, learn what a wealth manager does.

-

You should learn all the laws concerning the securities market.

-

It is essential to understand the basics of tax and accounting.

-

After completing your education, you will need to pass exams and take practice test.

-

Register at the official website of your state.

-

Apply for a work permit

-

Give clients a business card.

-

Start working!

Wealth advisors typically earn between $40k and $60k per year.

The size of the business and the location will determine the salary. So, if you want to increase your income, you should find the best firm according to your qualifications and experience.

To sum up, we can say that wealth advisors play an important role in our economy. Everybody should know their rights and responsibilities. Additionally, everyone should be aware of how to protect yourself from fraud and other illegal activities.