When getting a divorce, you will need to protect your assets and get financial advice from a financial planner. Although divorce can be stressful, there are ways to make it easier. You can help protect your assets by setting up a safe deposit box and hiring a mortgage advisor for divorce. You can also consult with a professional forensic accountant to obtain a detailed picture of your spouse’s income and assets. To provide emotional support throughout the divorce process, it is a good idea that you work with a counselor.

A financial planner can help you with money and divorce advice

A financial planner is a wise financial decision during divorce. A financial planner can help plan for the future as well as manage your finances and establish savings accounts. They can also help determine who will receive what in the event of your spouse's death. Financial advisors can help you create a budget and decide who should be the beneficiaries of any estates.

Protect your assets

It is essential to protect your assets when you are splitting with your spouse. Divorce is a very emotional time, and it can also have a serious financial impact on your children and future. It is important to identify your assets, their location, and who has access. It can be time-consuming to compile a list of all your financial assets and keep track of where they are.

Negotiate with your ex spouse

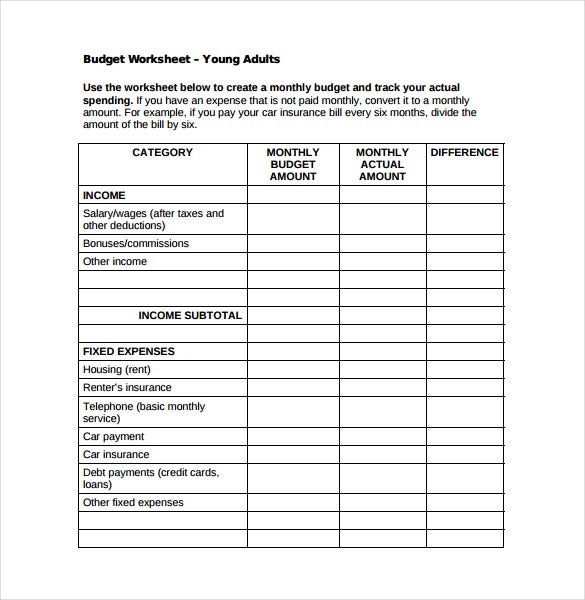

You should consider your financial goals and needs when you negotiate a divorce settlement. This requires creating a postdivorce financial budget and convincingly arguing for alimony. By creating a post-divorce financial plan, you can visualize your future and see what your needs are. This will help you convince your ex-spouse or partner to accept your request for alimony.

Get a safe deposit box

A safe deposit box is the best place to keep important documents and valuables. Whether you have a marriage contract or an appraisal of your house, it is best to store important papers in a safe deposit box. This box is also a great place to store household inventory, appraisals, as well as insurance policies. Safe deposit boxes are also recommended for military records. The best thing about this kind of box is that only you can access it. This makes it the best place to keep important documents and papers.

Divorce debts can be managed

Most decrees relating to divorce include provisions that address the debts. These provisions can help you save time, anxiety, money, and even pay your attorney's fees. Prenuptial agreements will be honored by courts.

Social Security Security

Financial planners can help you to protect your Social Security during a divorce. Separation from your spouse in financial matters can cause anxiety and make it difficult to navigate. Assessing your financial situation is the first step. Make sure you are on a good track. It is vital to keep copies and records of all your financial records.

After a divorce, organize financial records

If you're facing divorce, one of the most important steps is to organize your financial records. You should gather all financial records going back at most five years. This will help you understand exactly how much money you have and what your current financial situation is. Your tax returns and brokerage statements should be included in the information you gather. It's also important to collect all data pertaining to your marital lifestyle. The information you gather should be stored in a safety deposit box.

FAQ

How can I get started in Wealth Management?

You must first decide what type of Wealth Management service is right for you. There are many Wealth Management service options available. However, most people fall into one or two of these categories.

-

Investment Advisory Services- These professionals will help determine how much money and where to invest it. They advise on asset allocation, portfolio construction, and other investment strategies.

-

Financial Planning Services - This professional will work with you to create a comprehensive financial plan that considers your goals, objectives, and personal situation. He or she may recommend certain investments based on their experience and expertise.

-

Estate Planning Services – An experienced lawyer can guide you in the best way possible to protect yourself and your loved one from potential problems that might arise after your death.

-

Ensure they are registered with FINRA (Financial Industry Regulatory Authority) before you hire a professional. You can find another person who is more comfortable working with them if they aren't.

What is wealth administration?

Wealth Management is the practice of managing money for individuals, families, and businesses. It covers all aspects of financial planning including investment, insurance, tax and estate planning, retirement planning, protection, liquidity and risk management.

Who can I trust with my retirement planning?

Many people consider retirement planning to be a difficult financial decision. It's not just about saving for yourself but also ensuring you have enough money to support yourself and your family throughout your life.

It is important to remember that you can calculate how much to save based on where you are in your life.

If you're married you'll need both to factor in your savings and provide for your individual spending needs. If you are single, you may need to decide how much time you want to spend on your own each month. This figure can then be used to calculate how much should you save.

If you are working and wish to save now, you can set up a regular monthly pension contribution. Consider investing in shares and other investments that will give you long-term growth.

You can learn more about these options by contacting a financial advisor or a wealth manager.

How to Choose an Investment Advisor

Choosing an investment advisor is similar to selecting a financial planner. Consider experience and fees.

It refers the length of time the advisor has worked in the industry.

Fees represent the cost of the service. These fees should be compared with the potential returns.

It's crucial to find a qualified advisor who is able to understand your situation and recommend a package that will work for you.

Who should use a wealth manager?

Everyone who wishes to increase their wealth must understand the risks.

For those who aren't familiar with investing, the idea of risk might be confusing. Poor investment decisions could result in them losing their money.

It's the same for those already wealthy. It's possible for them to feel that they have enough money to last a lifetime. But this isn't always true, and they could lose everything if they aren't careful.

Each person's personal circumstances should be considered when deciding whether to hire a wealth management company.

What is estate planning?

Estate planning involves creating an estate strategy that will prepare for the death of your loved ones. It includes documents such as wills. Trusts. Powers of attorney. Health care directives. The purpose of these documents is to ensure that you have control over your assets after you are gone.

Statistics

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

- Newer, fully-automated Roboadvisor platforms intended as wealth management tools for ordinary individuals often charge far less than 1% per year of AUM and come with low minimum account balances to get started. (investopedia.com)

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

External Links

How To

How to invest when you are retired

Retirees have enough money to be able to live comfortably on their own after they retire. However, how can they invest it? There are many options. You could, for example, sell your home and use the proceeds to purchase shares in companies that you feel will rise in value. You could also purchase life insurance and pass it on to your children or grandchildren.

You can make your retirement money last longer by investing in property. As property prices rise over time, it is possible to get a good return if you buy a house now. Gold coins are another option if you worry about inflation. They don't lose their value like other assets, so it's less likely that they will fall in value during economic uncertainty.