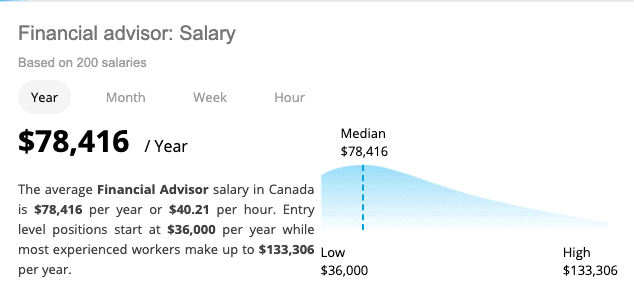

Average base salary for bank financial advisors is $78,414/year. Their compensation can also be based on commissions which can make the job more lucrative. ZipRecruiter calculates salaries from job postings as well as third-party data sources. There are many financial advisor salaries that can be significantly higher or lower then the average. Some financial advisors earn more than the average. Additionally, certain jobs might offer greater benefits like bonuses and retirement savings.

Average base salary

The average salary for a financial advisor is $65,000. It varies from one state to another. Wall Street, New York is the most highly paid state for a financial adviser in May 2017, earning a median annual wage of $166,000. Close behind was California, which was $141,100, followed by Connecticut, New Jersey, the District of Columbia, and Maine, each with an average base salary that was $20,870 higher than the national average.

Base Salary based on experience

A financial advisor makes between $60,000 and $110,000 per year, and the range of compensation is much wider than the average. Pay depends on experience and client volume. The top-quartile Service advisor earns about $25,000 more than the average. Lead advisors make almost $160,000 per year while Practicing Partners make almost twice that amount. Before recommending an investment, a financial advisor should be familiarized with the state tax laws.

Base salary determined by the state

Bank Financial Advisors earn a range of salaries, depending on where they live. The median income for an advisor in southeast Nebraska, at $52,530, is lower than the mean annual salary in many other states. Depending on their job role, a financial consultant may be called a Financial Advisor, Independent, Financial Analyst, and Senior Financial Advisor. There are some states where the base pay of a bank's financial advisor is different depending on their region and industry.

Compensation based upon commissions

Financial advisors who are paid commissions might not be the best choice for all clients. Commissions are important but they should not be the only source of financial advisors' compensation. Sometimes, compensation can include soft-dollar fees or surrender fees on investment products. Advisors should be able and willing to discuss compensation with clients.

Compensation based in profit-percentage structures

A financial advisor's compensation will depend on how much experience they have. The size of the client base and the growth of the business will affect the amount of compensation a financial advisor can earn. A top-quartile Service adviser would earn $25,000 more per year than the average Lead advisor. A top-quartile Practicing partner would also earn more than twice the average lead advisor.

FAQ

What is retirement planning?

Planning for retirement is an important aspect of financial planning. It helps you plan for the future, and allows you to enjoy retirement comfortably.

Retirement planning is about looking at the many options available to one, such as investing in stocks and bonds, life insurance and tax-avantaged accounts.

How to Begin Your Search for A Wealth Management Service

Look for the following criteria when searching for a wealth-management service:

-

Proven track record

-

Is it based locally

-

Consultations are free

-

Supports you on an ongoing basis

-

Is there a clear fee structure

-

Excellent reputation

-

It's simple to get in touch

-

You can contact us 24/7

-

Offers a range of products

-

Low fees

-

Does not charge hidden fees

-

Doesn't require large upfront deposits

-

You should have a clear plan to manage your finances

-

Is transparent in how you manage your money

-

This makes it easy to ask questions

-

A solid understanding of your current situation

-

Understand your goals & objectives

-

Is available to work with your regularly

-

Work within your budget

-

Does a thorough understanding of local markets

-

We are willing to offer our advice and suggestions on how to improve your portfolio.

-

Is available to assist you in setting realistic expectations

What is investment risk management?

Risk Management is the practice of managing risks by evaluating potential losses and taking appropriate actions to mitigate those losses. It involves monitoring, analyzing, and controlling the risks.

An integral part of any investment strategy is risk management. The goal of risk-management is to minimize the possibility of loss and maximize the return on investment.

These are the key components of risk management

-

Identifying the risk factors

-

Monitoring and measuring the risk

-

Controlling the Risk

-

How to manage risk

How old should I be to start wealth management

Wealth Management is best done when you are young enough for the rewards of your labor and not too young to be in touch with reality.

You will make more money if you start investing sooner than you think.

You may also want to consider starting early if you plan to have children.

If you wait until later in life, you may find yourself living off savings for the rest of your life.

What is a Financial Planning Consultant? And How Can They Help with Wealth Management?

A financial planner can help you make a financial plan. They can help you assess your financial situation, identify your weaknesses, and suggest ways that you can improve it.

Financial planners are professionals who can help you create a solid financial plan. They can help you determine how much to save each month and which investments will yield the best returns.

Financial planners are usually paid a fee based on the amount of advice they provide. Certain criteria may be met to receive free services from planners.

How to beat inflation with savings

Inflation can be defined as an increase in the price of goods and services due both to rising demand and decreasing supply. Since the Industrial Revolution, when people started saving money, inflation was a problem. The government controls inflation by raising interest rates and printing new currency (inflation). However, there are ways to beat inflation without having to save your money.

For example, you could invest in foreign countries where inflation isn’t as high. You can also invest in precious metals. Two examples of "real investments" are gold and silver, whose prices rise regardless of the dollar's decline. Investors who are concerned about inflation are also able to benefit from precious metals.

What is estate plan?

Estate Planning is the process of preparing for death by creating an estate plan which includes documents such as wills, trusts, powers of attorney, health care directives, etc. These documents ensure that you will have control of your assets once you're gone.

Statistics

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

External Links

How To

How to become an advisor in Wealth Management?

Wealth advisors are a good choice if you're looking to make your own career in financial services and investment. There are many opportunities for this profession today. It also requires a lot knowledge and skills. These are the qualities that will help you get a job. A wealth advisor's main job is to give advice to investors and help them make informed decisions.

To start working as a wealth adviser, you must first choose the right training course. You should be able to take courses in personal finance, tax law and investments. You can then apply for a license in order to become a wealth adviser after you have completed the course.

Here are some tips on how to become a wealth advisor:

-

First, let's talk about what a wealth advisor is.

-

It is important to be familiar with all laws relating to the securities market.

-

It is important to learn the basics of accounting, taxes and taxation.

-

After you complete your education, take practice tests and pass exams.

-

Finally, you must register at the official website in the state you live.

-

Apply for a Work License

-

Get a business card and show it to clients.

-

Start working!

Wealth advisors often earn between $40k-60k per annum.

The salary depends on the size of the firm and its location. So, if you want to increase your income, you should find the best firm according to your qualifications and experience.

As a result, wealth advisors have a vital role to play in our economy. Therefore, everyone needs to be aware of their rights and duties. You should also be able to prevent fraud and other illegal acts.